Why condition reports are important

As the name suggests, a condition report records the state and condition of the entire property, both inside and outside the property. From recording the state of door frames and skirting boards, to walls and light fittings, it should detail the exact condition of each room. It even includes the condition of fixtures and fittings,.

New regulations mean a level playing field for prospective tenants

With Christmas festivities taking priority, you may have missed the new regulations to help prospective tenants secure housing in a tight rental property market in a fair way, which came in at the end of December. Rental bidding banned Rental bidding is the practice where a landlord or agent invites, suggests or asks prospective tenants.

What is ‘wear and tear’?

At the end of a tenancy, the tenant is responsible for leaving the property as near as possible to the same condition as when they started living in it. Condition reports made at the start of a tenancy help avoid any disputes at the end of a tenancy. These document the condition of the wall,.

Landlord Christmas checklist

Decorating the tree, buying the perfect presents, ensuring there is enough food in the house… there is a lot to do at this time of year! So, what should be on your property investment ‘to do’ list over the festive period? If you’ve got a manager like us, there’s not actually too much to do!.

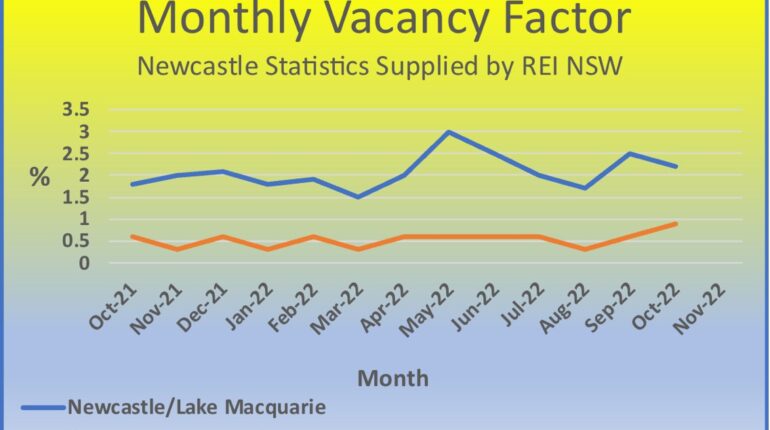

Vacancy rates in Newcastle and Lake Macquarie

The CoreLogic home value report shows while housing is taking a relative downfall, rental value growth actually remains high across Australia; the report suggest regional rents are up 25.5%., and indeed, we have seen rents increase over the past few months, although not by this much. What this means is, as rents continue to rise.

4 reasons why routine inspections are necessary

As a property manager, as well as finding quality and reliable tenants and securing the best possible rental return we are committed to ensuring your property is maintained to a high standard and is in good condition. Legally we are allowed to make up to four inspections in a 12-month period. Unless there are extenuating.

Consultation on two residential tenancy laws – have your say

To ensure tenants are safe, secure and happy in their homes, legislation is periodically reviewed to see if any reforms need to be made. Around 33 % of people are renting in NSW; to see if any improvements can be made to two residential tenancy laws, the NSW Government is currently looking for feedback from.

What to look for in a good mortgage broker

With seven consecutive months of rate rises, many mortgage holders are probably reassessing their finances and may be looking to change their loan. This is by no means an easy task; according to one comparison website, there are 5400+ loans available. While having choices at your fingertips gives more opportunities, inputting your details, reading all.