How to pick a good suburb

Two of our region’s suburbs, Belmont and Kotara, have made it to the Smart Property Investment FAST 50 report. This report presents a list of 50 suburbs across the country that are predicted to experience significant capital growth in the next 12 months.

For the property investor, choosing the right suburb is crucial for maximising returns and minimising risks, and also will have an impact on the value and potential growth of your investment property.

The FAST 50 has drawn on both expert opinion and property data; giving a report supported by both qualitative and quantitative analysis. Data reviewed includes quarterly growth, 12-month growth, gross rental yield and 10-year average annual growth.

So why are these suburbs earmarked for growth?

The report describes the city suburb Kotara as ‘a suburb known for its convenient lifestyle, shopping destinations, and family-friendly environment. The suburb offers a variety of housing styles, appealing to families, professionals, and retirees. Kotara’s amenities, including schools, parks, and the renowned Westfield Kotara shopping centre, add to its appeal as a vibrant and convenient place to live, with links across Greater Newcastle and Lake Macquarie, and convenient train access to Sydney.’

Meanwhile, Belmont, situated in the Lake Macquarie region, is known for its ‘beautiful lake views, recreational activities, and commutable proximity to both Newcastle and Sydney, as well as the Central Coast. This suburb offers a relaxed lifestyle with a variety of housing options, from waterfront properties to suburban homes. Belmont is ideal for families, retirees, and those who enjoy outdoor activities and a serene environment.

These are two very different locations, but they do have some features in common which make them contenders for areas to invest in.

Both offer good lifestyle options, making them desirable areas to live for potential tenants or and indeed buyers for if you want to sell the investment property, quickly and at a profit, later down the track. Desirable features include proximity to schools, parks, public transport, and shopping centres.

What else do you need to research?

- Strong rental demand

Desirable suburbs often attract a high rental demand. Factors such as population growth, employment opportunities, and the local rental market all contribute to being a good suburb to invest in.

- Rental yield

Know what you can afford. Seek the advice of a financial specialist who can advise accordingly.

Not everyone has the budget to invest in a very desirable area to live in, and investors need to factor in how much they need to borrow. As a result, you may find you get more bang for your buck in terms of rental yield if you buy a less expensive property in the next suburb; while the rents will be less, the chances are, your mortgage will be less too, so your outgoings will be less.

- Future potential

Look for suburbs that are experiencing growth and development. Suburbs with upcoming infrastructure projects or improvements are often good options. Consider the suburb’s future growth potential and whether there are any plans for new developments or investments in the area.

- Understand the local property market

Consider the supply and demand dynamics of the local property market in the suburb you are considering. Look at factors such as the number of properties on the market, days on market, and auction clearance rates.

As one of Newcastle’s longest established real estate agents, we can give you more local insights to help you make an informed decision. Take a look at our summer market report to find out more about the local market.

And explore market trends, median prices, property statistics and recent sales across suburbs in your area using our Suburb Market Report tool here.

Having been property managers for nearly 50 years, we know what to look for, what to consider and how to maximise rental return to help you get the best from your property.

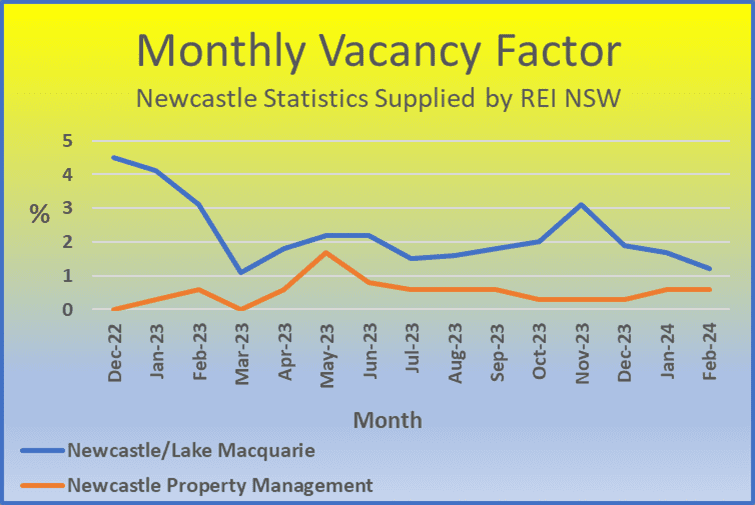

And our vacancy rates are consistently lower than the average: the official rate is at a 11-month low of 1.2% currently however we are about half of that.

If you’ve seen a potential investment property on the market, get in touch; we will give you an honest opinion and highlight anything you need to consider. We can also fill you in on how our property management services will make your life easier.

Drop into the Cardiff office or give us a call on 02 4956 9777. Or send us an email at mail@newcastlepropertymanagement.com.au – we’ve helped many people realise their financial dreams through property and we’re keen to help you.