How the Budget Affects Property Owners

Last month, the 2025–26 Federal Budget announced several measures that will impact both residential and investment property owners. Here we look at some of them. How the budget impacts property investors The Government has increased maximum rates of Commonwealth Rent Assistance by 45% for approximately 1 million households. Additionally, a framework is being implemented to.

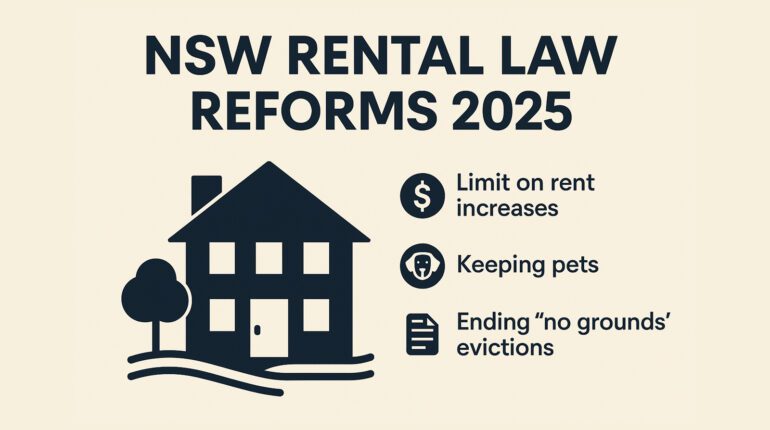

A Comprehensive Overview of the NSW Rental Reforms

Aimed to improving tenant protections, enhancing rental security, and creating a fairer housing market, as well as promoting sustainability, the Government has implemented significant reforms to the Residential Tenancies Act 2010 (NSW) (RTA). These reforms are part of a broader national conversation about housing affordability and tenant rights, responding to growing concerns among renters and.

Rental property dual-flush deadline

As of 23 March 2025, New South Wales (NSW), Australia, new water efficiency rules aimed at promoting sustainability, reducing water waste, and ensuring fair usage across residential and rental properties will come into play. Here’s what you need to know about the new water efficiency rules. The legislation Around 40% of household water is used.

10-point checklist to choosing a mortgage broker

With the recent interest rate cut, and some lenders predicting further cuts this year, whether you’re looking to invest, you’re thinking of moving, or looking for a better deal on your mortgage, now might be the time to review finances and see what your borrowing options are. A good mortgage broker can simplify this process,.

Fire safety and smoke alarm regulations: a guide for landlords

As a landlord, ensuring the safety of your tenants is not only a moral obligation but also a legal requirement. Fire safety is a critical element of property management, and understanding the regulations surrounding smoke alarms is essential to protect your investment and the lives of those who occupy your buildings. Legislative Framework The primary.

New strata laws take effect

The new strata laws that took effect on 3 February 2025 in NSW have changed the way strata managing agents are required to disclose information to owners’ corporations. These changes are designed to increase transparency and ensure that strata managers are upfront with owners about kickbacks and conflicts of interest. The expanded disclosure requirements mandate.

Why you should consider investing in property in 2025

Last month, property analyst Hotspotting announced the data from its Summer 2024 Price Predictor Index, which assessed the suburbs with the steadiest conditions for long-term capital growth. NSW saw ten suburbs on the list, and our very own Charlestown in Lake Macquarie was up there with Lithgow and Springwood in the Blue Mountains as a.

7 New Year resolutions for landlords

While we are in the second month of the calendar year, we have just celebrated the Chinese New Year, so it’s still timely to suggest some resolutions for property investors for 2025. This year, it’s the Year of the Snake; apparently, it’s all about strategy, transformation, and smart investments—qualities that perfectly complement property investment! So.