Pros and cons of investing in a unit

According to the Real Estate Institute of Australia (REIA) Real Estate Market Facts report for the March quarter, smaller dwellings are leading the way, with two-bedroom properties out performing houses in both price and rental growth.

REIA’s President, Ms Leanne Pilkington suggests this trend reflects changing household compositions, affordability constraints and increasing demand for more manageable, lower-maintenance housing options.

“With price growth, rental demand and low vacancy rates converging, smaller dwellings are becoming a strategic choice for both investors and downsizers,” she says.

Given this latest trend, let’s take a look at the pros and cons of investing in smaller dwellings, in particular units.

Pros

- More affordable

Units are generally cheaper than similar sized houses, which means there is a lower initial capital outlay, and less stamp duty to pay.

- Strong rental demand

Inner-city units are popular among renters—professionals, students, and downsizers—leading to potentially stronger rental yield and lower vacancy rates.

According to Ms Pilkington, weekly rents for two-bedroom dwellings rose 3.5% nationally to $648, compared to a 0.6% increase for three-bedroom houses, now at $628 per week.

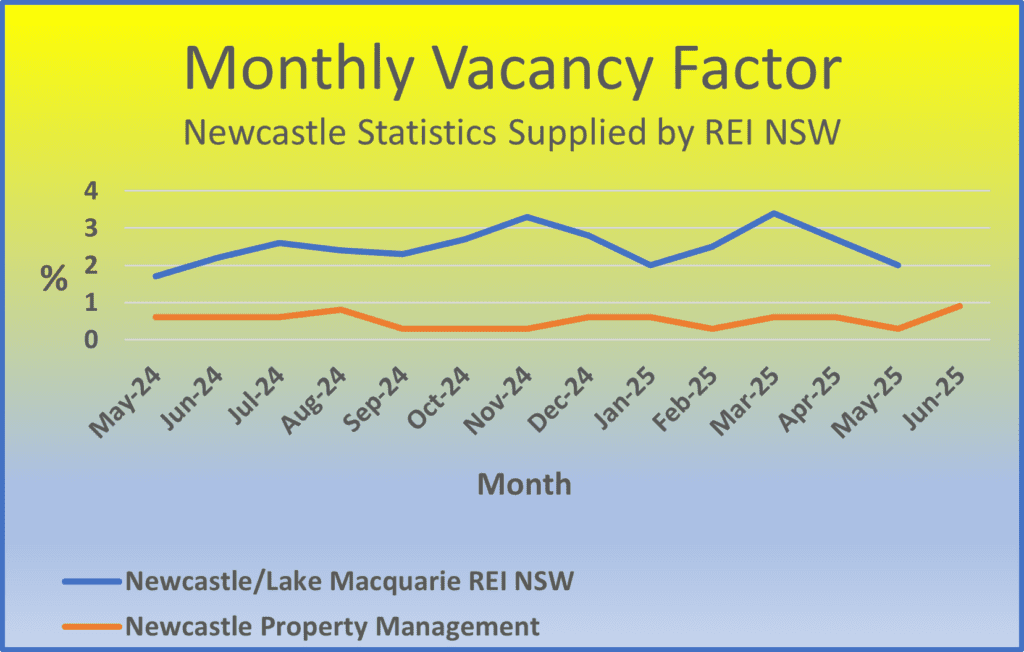

Vacancy rates in the Newcastle area remain low generally, and our data shows we are consistently below the regional average.

- Lower maintenance and upkeep

With strata management in charge of communal areas like gardens and amenities, and very often manage other maintenance such as clearing gutters, individual investors have fewer maintenance responsibilities.

- Access to amenities

Units often come with gyms, pools or security—features renters value, helping attract tenants and justify slightly higher rents.

- Diversification & scalability

Units give investors the opportunity to spread capital over more properties. This reduces concentration risk. Some may also argue, it’s easier to manage multiple units than several standalone homes.

Cons of investing in units

- Strata fees & levies

Unlike individually owned houses, there are additional costs associated with units, such as strata fees and these may increase annually. Furthermore, special levies may arise for major works such as for cladding upgrades, or lift maintenance or replacements.

- Strata by-laws

Some strata corporations have strict by-laws, such as unable to hang washing on balconies. This can be off-putting for tenants, and there is the risk of tenants breaking the by-laws. However, this is less of a risk if the tenant is aware of all the strata by-laws from the outset, and signs to agree they will abide by them.

- Lower capital growth prospects

Unless situated in prime and very desirable locations, units and apartments may not experience the same capital gains as houses.

- Management & developer risk

There have been reports of poor-quality construction and developer insolvency posing risks for some of the new builds. This is less of a risk for long standing, and well-established developments.

- Limited tenant profile

With many units being just two or three bedrooms, it does limit who will want to live there. Some may argue that there is a risk of shorter-term tenants—such as students —and this could lead to higher vacancy turnover-related expenses. However, many tenants, particularly young professionals, actively look for units because they are usually less expensive to rent, they are close to amenities and the lifestyle they want, and they haven’t got to worry about a garden.

Many property investors have a mix of houses and units in their portfolio; however, particularly if you’re starting out, the important thing to remember is to do your budgeting, know your finances and know what is and isn’t tax deductible. For instance, for a unit, strata fees will be tax deductible, and you may find maintenance costs can be claimed back.

Speak to a financial expert who can advise accordingly.

Another important consideration is to ensure your property is managed properly, and you are getting the maximum return for your investment.

This is where we come in. From finding tenants and managing maintenance, to handling the paperwork and communicating with tenants, and strata managers, we manage every aspect of your property, so you have the time to do what you want to do.

As one of Newcastle’s longest established real estate offices, we know property. Whether it is from an investment or homeowner’s point of view, we’re always looking at innovative ways to help you get the best from your asset.

Drop into the Cardiff office or give us a call on 02 4956 9777. Or send us an email at mail@newcastlepropertymanagement.com.au – we’d love to help you realise your financial dreams through property.

Don’t forget to check out our Facebook page for handy tips on selling your property or what to look for when buying a property.