Investor Activity Still Strong

Property is still a popular option to invest in according to the latest Australian Bureau of Statistics (ABS) lending figures. Its latest figures show investor lending was up 35.4% in July to $11.7 billion, closing in on a record high of $11.8 billion reached in January 2022.

At the same time, property data specialists CoreLogic also found the while rents have flatlined in July and August, most cities are still recording an annual rental trend that is well above the pre-COVID average. Nationally, rents were rising at the average annual pace of just 2.0% per annum in the ten years before March 2020.

A landlord’s market

Many will still argue Australia is experiencing a landlord’s market; there is still a high demand for rental properties, low vacancy rates, and rising rental prices. According to CoreLogic, rental values surged by an average of 10.2% in the 12 months leading to September 2023, indicating a robust rental landscape.

Factors supporting this include:

- Supply constraints: Over the past couple of years, the construction industry has faced disruptions due to supply chain issues, rising materials costs, and a reduction in the number of new residential developments. Consequently, a limited housing supply continues to drive rental prices upward.

- Increased immigration and population growth: With Australia reopening its borders post-pandemic, there has been an influx of immigrants and international students. This growth increases the demand for rental properties, further solidifying the landlord’s position in the market.

Time to review your finances

If you are thinking about property as an investment option, reviewing personal finances is an essential first step. Here are some points to consider:

- Assess affordability: By examining your financial situation, you can better understand your borrowing capacity, and then you can start to find a suitable investment property within your budget.

- Research investment strategies: Reviewing finances allows you to plan your investment strategy. For instance, you may decide to negative gear your property to take advantage of some of the tax breaks. Alternatively, a positively geared property, will give you some extra in your back pocket.

- Think about tax benefits: Property investors can benefit from various deductions, including mortgage interest, maintenance costs, and management fees.

- Investor portfolio diversification: Real estate can serve as a hedge against inflation and provide diversification in an investment portfolio, which is vital for long-term financial stability.

Having been nearly 50 years in the business, we still believe investing in property can help you work towards your financial goals. So why not speak to financial specialist who will help you make informed decisions according to your financial situation.

Of course, once you’ve bought your investment property, you are going to need a good manager.

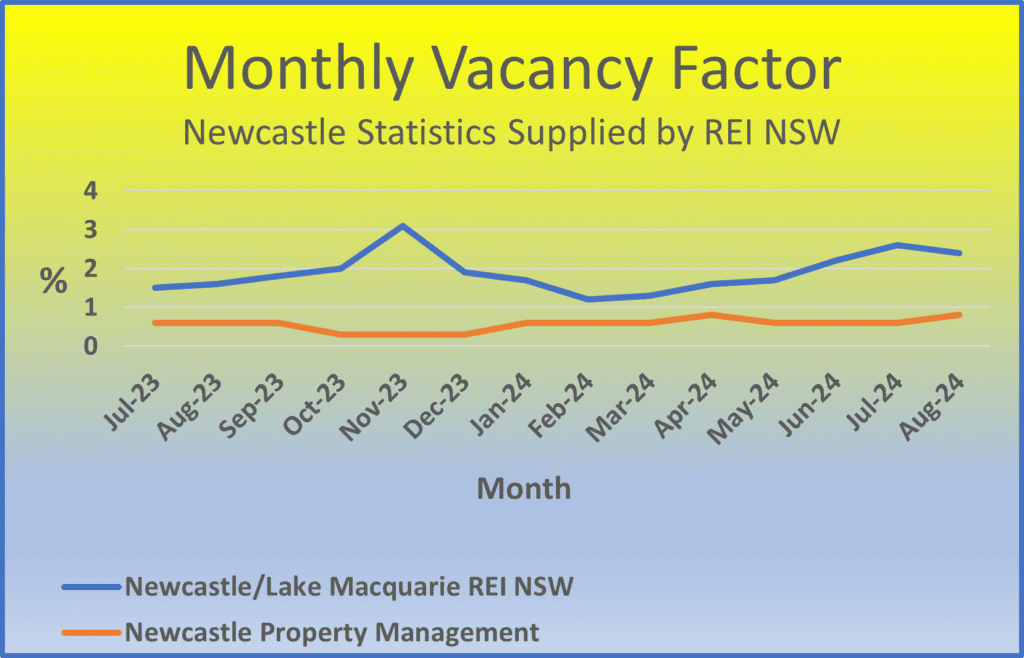

Our vacancy rates continue to stay lower than the average.

Low vacancy rates are just one reason why many investors choose us to manage their properties.

We also have an award-winning property manager heading up our team!

From knowing the legalities and an ensuring your asset is maintained in excellent condition, to suggesting ways to add value and giving information so you can make informed decisions about your investment property, if you want to find out more about our property management services, please call us on 02 4956 9777, send us an email to: mail@newcastlepropertymanagement.com.au or call into the office if you want to know more.