Investor loans are on the rise

Confidence appears to be returning to the property market, with the recent to data released by the Australian Bureau of Statistics (ABS) showing a rise in loans for both owner-occupier and property investors,

The value of new loans to investors for housing rose 5.6 per cent in April to $10.9 billion, which was 36.1 per cent higher compared to a year ago.

In original terms, the average size of an investor loan for the purchase of an existing dwelling grew 9.5 per cent since April 2023, from $592,000 to $648,000. In comparison, the average loan size for an owner‑occupier first home buyer grew 6.8 per cent, from $498,000 to $532,000 over the same period.

Dr Mish Tan, ABS head of finance statistics, said: “Lending to investors continued to rise strongly relative to owner-occupiers, driven by increasing loan sizes. This likely reflects expectations of higher rental yields and the greater borrowing capacity of investors.”

Owner occupier loans

In April 2024 in seasonally adjusted terms for owner-occupier housing, the value of new loan commitments:

- for the purchase of existing dwellings rose 3.4% and was 18.0% higher compared to a year ago

- for the construction of new dwellings rose 6.0% and was 16.8% higher compared to a year ago

- for the purchase of new dwellings rose 10.8% and was 22.4% higher compared to a year ago

Looking at the number of loans, new owner-occupier first home buyer loans rose 3.0 per cent in the month to be 10.8 per cent higher compared to a year ago.

Affordability

REIA’s latest Housing Affordability Report found that the proportion of income required to meet average loan repayments fell 1.0 percentage points to 46.7% over the March 2024 quarter. The improvement can be attributed to stronger wage growth and a pause in interest rate hikes.”

Real Estate Institute of Australia (REIA) President, Ms Leanne Pilkington believed the improvement can be attributed to stronger wage growth and a pause on interest rate hikes.

This is the first improvement in housing affordability since a series of successive increases from the March quarter 2021 through to the December quarter 2023 saw this figure reach a high of 47.7%.

And good news for our state, she pointed out housing affordability had improved in New South Wales, rising to 2.2%.

However, while housing affordability has improved, the figures show rental affordability declining.

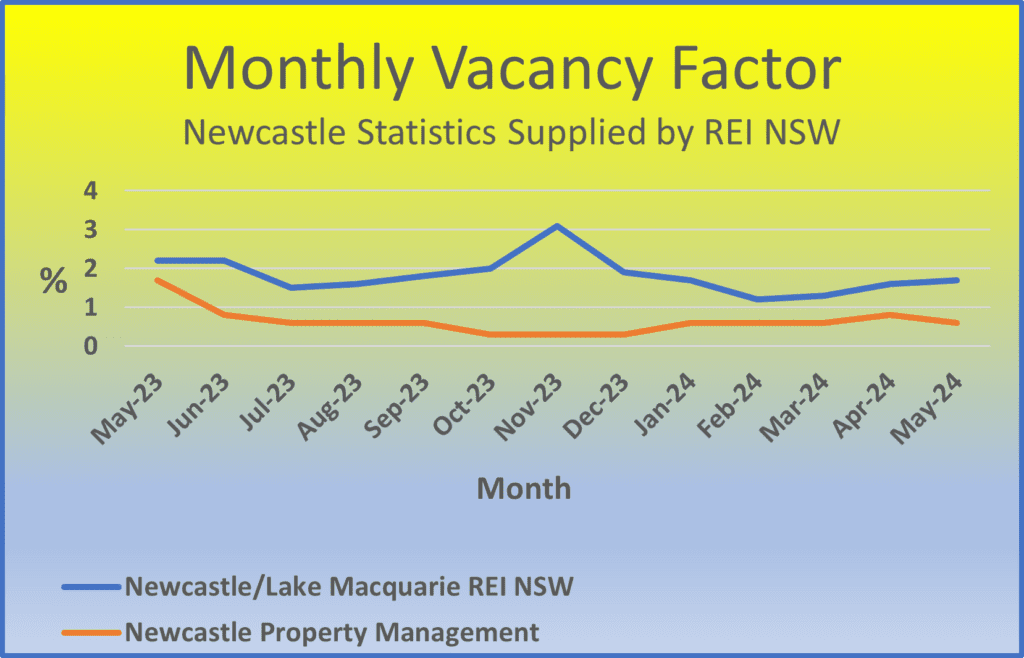

Low vacancy rates

Investors shouldn’t be too worried by these recent figures; despite the fall in rental affordability, vacancy rates are still low and rental properties are still very much in demand.

According to SQM Research the vacancy rate for May for the Hunter Region is currently at 1.4%, however we are lower than that.

Having been property managers for nearly 50 years, we know what to look for, what to consider and how to maximise rental return to help you get the best from your property.

If you’ve seen a potential investment property on the market, get in touch; we will give you an honest opinion and highlight anything you need to consider. We can also fill you in on how our property management services will make your life easier.

Drop into the Cardiff office or give us a call on 02 4956 9777. Or send us an email at mail@newcastlepropertymanagement.com.au – we’ve helped many people realise their financial dreams through property and we’re keen to help you.